RAFA is an AI investment agent. It helps you invest like an expert with personalized insights. It’s like having a team of expert analysts specializing in fundamental analysis, technical analysis, momentum trading, macroeconomic trends, and more, all working together to maximize your portfolio 24/7. Get concise, timely stock summaries relevant to you. Discover hidden nuances in company financials, earnings reports, SEC filings, and more. Transform your investment strategy with RAFA’s advanced, AI-driven insights.

What is RAFA?

RAFA is an AI agent.Transform your investment strategy with RAFA. Experience the power of AI-driven insights and expert analysis, providing you with personalized, real-time stock summaries and uncovering hidden nuances in financial reports to maximize your portfolio 24/7.

RAFA AI Investment Copilot app is available in the playstore : Click here to download RAFA AI Investment Copilot app

RAFA AI Investment Copilot app is available in the Appstore : Click here to download RAFA AI Investment Copilot app from App store

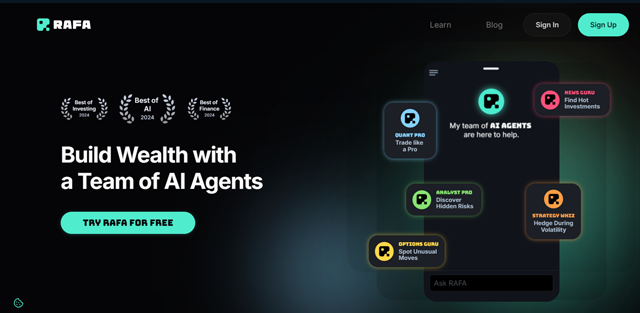

Build Wealth with AI: Your Team of Investment Superheroes (Free Trial)

What are the key features of RAFA?

- Portfolio risk analysis.

- Screen stocks.

- Team of AI agents.

- Activity monitoring.

- Real-time portfolio monitoring.

- Summaries.

- Portfolio alerts.

- Indices.

- Top stock ideas.

- New insights.

- Market clusters.

- Watchfolios.

- Customization.

- SEC filings.

- Market trends.

- Financial news.

- Investment recommendations.

- Quant agents.

- Language models.

What are the use cases of RAFA?

- Analyze portfolio risk.

- Find investment opportunities.

- Stay informed.

- Gain market insights.

- Make informed decisions.

- Customize your experience.

- Create custom strategies.

- Dividend harvesting.

- Tax-optimized investing.

- Backtesting strategies.

- Compare portfolios.

How does RAFA work?

Step 1: User Profile Setup.

Step 2: Data Aggregation.

Step 3: AI Analysis.

Step 4: Personalized Insight Generation.

Step 5: Concise Summaries.

Step 6: Real-Time Monitoring.

Step 7: Alerts and Recommendations.

Step 8: User Interaction.

Step 9: Portfolio Adjustment.

Step 10: Continuous Learning.

How much does RAFA cost?

RAFA Plus Yearly

Cost: $299.99/year

14-day free trial.

Features:

- Unusual Options

- Watchfolios

- Portfolio Analysis

RAFA Plus Monthly

Cost: $29.99/month

14-day free trial.

Features:

- Unusual Options

- Watchfolios

- Portfolio Analysis

What are the pros and cons of RAFA?

Pros of RAFA

- Insights.

- Recommendations.

- Industry standard encryption techniques.

- Personalized portfoliocassessment.

- Trend predictions.

- Smarter investing.

- Accuracy.

- Reliability.

- Expert oversight.

- Real-time stream.

- user-friendly.

Cons of RAFA

- Cost.

- AI dependence.

- Limited control.

RAFA pricing 2025: Plans, Features, and Subscription Costs Explained

RAFA pricing 2025: Plans, Features, and Subscription Costs Explained

- RAFA pricing plans start at $29.99 per month and includes a 14-day free trial.

RAFA Reviews & Ratings: See What Users and Experts Are Saying

RAFA Reviews & Ratings: See What Users and Experts Are Saying

RAFA FAQ: Learn How to Use It, Troubleshoot Issues, and More

RAFA FAQ: Learn How to Use It, Troubleshoot Issues, and More

RAFA offers personalized insights, stock summaries, and expert analysis to optimize your portfolio.

You set up RAFA by creating a user profile with your investment goals and preferences.

RAFA uses AI to analyze your portfolio for hidden risks and opportunities.

Yes, RAFA offers a 14-day free trial for both the yearly and monthly plans.

Unusual options updates provide real-time alerts on significant options activity that could impact markets.

Watchfolios let you test model portfolios before investing real money.

RAFA gives concise, timely summaries of stocks relevant to your interests.

Yes, RAFA offers real-time portfolio monitoring and alerts.

RAFA provides new market insights, top stock ideas, and detailed financial analysis.

Yes, RAFA allows you to customize alerts, reports, and investment strategies.

RAFA uses AI for fundamental analysis, technical analysis, momentum trading, and macroeconomic trends.

Yes, RAFA uses industry-standard encryption techniques to ensure your data is secure.

Summary

Summary

RAFA AI's AI-driven insights, comprehensive feature set, and competitive pricing make it a top choice in the investment analysis and portfolio management market.